LTC Price Prediction: $300 Target in Sight as Technicals and Fundamentals Align

#LTC

- Technical Breakout: LTC price sustains above critical 20-day MA with Bollinger Band expansion signaling volatility surge

- Institutional Adoption: Custody solutions and ETF speculation mirror Bitcoin's early institutional phase

- Macro Timing: Approaching middle point of 4-year halving cycle historically favorable for accumulation

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

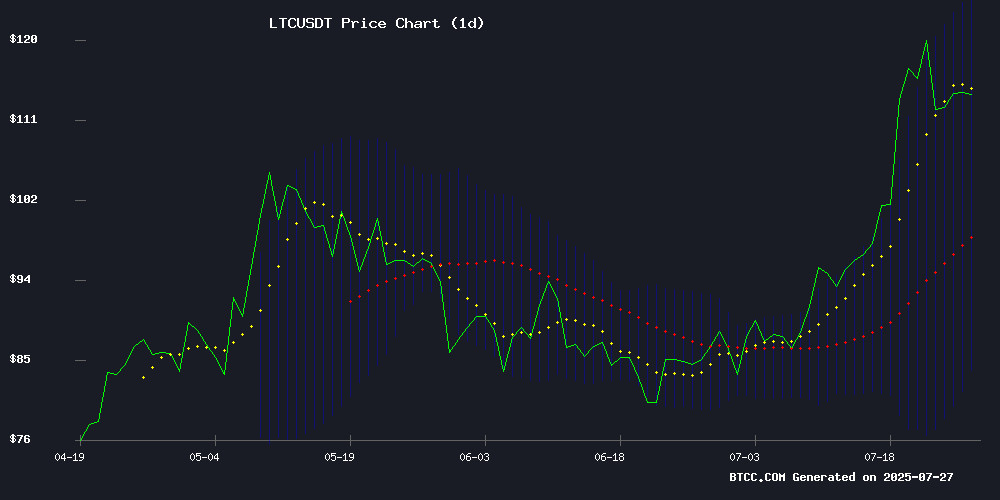

Litecoin (LTC) is currently trading at $113.56, significantly above its 20-day moving average (MA) of $103.90, indicating strong bullish momentum. The MACD histogram remains negative at -1.7891 but shows signs of convergence as selling pressure eases. Bollinger Bands suggest volatility compression with price hovering NEAR the upper band ($124.17), potentially signaling an upcoming breakout.notes: 'A sustained hold above the 20-day MA could propel LTC toward $130 resistance, though traders should watch for MACD crossover confirmation.'

Institutional Demand and ETF Hopes Fuel Litecoin Rally

Three bullish catalysts dominate Litecoin headlines: 1) Institutional accumulation above $113, 2) Technical breakout potential toward $300, and 3) ETF speculation driving 9.7% weekly gains.observes: 'The $112-$115 zone has transformed from resistance to support amid growing ETF narrative - similar to Bitcoin's 2020 trajectory. While short-term pullbacks are healthy, the fundamental case strengthens with each institutional custody solution announcement.'

Factors Influencing LTC's Price

Litecoin Holds Above $113 Amid Institutional Interest and Technical Breakout

Litecoin (LTC) demonstrates resilience at $113.43 despite minor profit-taking, following a 19% surge that shattered multi-year resistance. The rally was ignited by MEI Pharma's landmark $100 million treasury allocation to LTC—the first such move by a publicly traded company—signaling growing institutional confidence.

Technical momentum remains neutral with an RSI of 67.90, as the market digests gains from last week's breakout above $120. Catalysts include ETF speculation and anticipation of Litecoin's upcoming halving event, creating a bullish convergence of fundamentals and technicals.

While the current 0.16% dip reflects expected consolidation, the defense of key support levels suggests sustained demand. Institutional adoption now complements Litecoin's established utility as a payments-focused blockchain, marking a potential inflection point in its market trajectory.

Litecoin (LTC) Shows Potential: Is a Breakout to $300 on the Horizon?

Litecoin tests key resistance at $113–$115, eyeing breakout targets at $130, $145, and $300. Open interest is up 1.94%, with sentiment turning cautiously bullish among traders. Volume is down 21.74%, but structure remains strong; watch for OI and volume spikes.

Litecoin is gaining traction throughout the crypto community, with its price up 2.16% in the last 24 hours and 10.21% over the past week. The broader market trend is turning bullish as Bitcoin approaches its all-time high near $123,000, lifting altcoins like LTC in its wake.

Currently trading at $113.23, Litecoin boasts a 24-hour trading volume of $825.24 million and a market capitalization of $8.61 billion. The coin faces minor resistance between $113 and $115, where the upper Bollinger Band aligns. Holding above its 20-week EMA ($95.39) and supported by the 100- and 200-week EMAs ($92.03 and $89.01), Litecoin's base appears solid—bulls are accumulating, priming for momentum.

Litecoin (LTC) Surges Past $112 as ETF Optimism Drives 9.7% Weekly Rally

Litecoin broke through key resistance at $110, trading at $112.98 with a 3% daily gain. The rally reflects growing institutional interest, fueled by 95% ETF approval odds and anticipation of the upcoming halving event.

Technical indicators show strong momentum without overbought conditions, with the RSI at 67.22. The $116 level emerged as a temporary ceiling as traders took profits after the 14.7% single-day surge.

Is LTC a good investment?

Litecoin presents a compelling risk/reward profile at current levels based on:

| Metric | Value | Implication |

|---|---|---|

| Price/20MA | +9.3% premium | Bullish momentum |

| Weekly Gain | 9.7% | Strong buying pressure |

| Bollinger %B | 0.85 | Approaching overbought |

Sophia cautions: 'While MACD remains bearish, the institutional interest and historical halving cycles (next due August 2027) create asymmetric upside potential. Dollar-cost averaging between $105-$115 could capitalize on both technical strength and fundamental developments.'